Financial Assistant: Your Companion in Building a Secure Future

Financial Assistant: Your Companion in Building a Secure Future

Blog Article

Discover Reliable Car Loan Providers for All Your Financial Requirements

In browsing the substantial landscape of financial solutions, locating dependable financing providers that cater to your details needs can be a difficult job. Allow's check out some essential factors to take into consideration when looking for out financing services that are not just dependable yet likewise customized to meet your unique monetary needs.

Kinds Of Individual Fundings

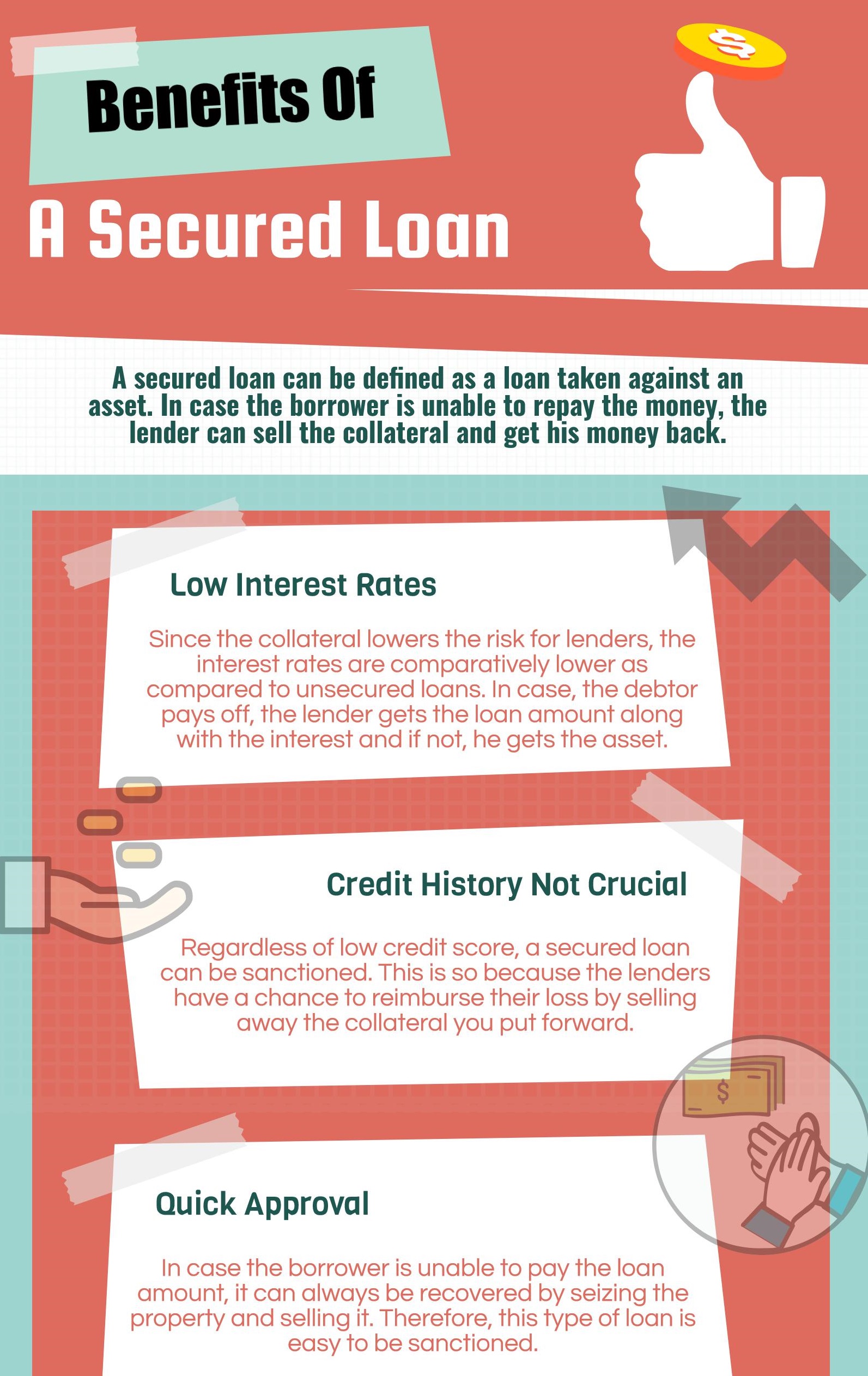

When considering individual finances, individuals can select from various kinds tailored to satisfy their specific monetary needs. One usual kind is the unprotected personal finance, which does not require security and is based on the borrower's credit reliability. These finances normally have higher rate of interest prices due to the raised risk for the loan provider. On the other hand, secured individual fundings are backed by collateral, such as a vehicle or interest-bearing accounts, leading to reduced rates of interest as the lender has a kind of protection. For individuals aiming to combine high-interest financial obligations, a financial obligation combination car loan is a viable option. This kind of lending integrates numerous financial obligations into a single month-to-month payment, often with a reduced passion rate. In addition, individuals looking for funds for home restorations or significant purchases might choose a home enhancement lending. These car loans are specifically designed to cover costs related to enhancing one's home and can be safeguarded or unprotected depending upon the lending institution's terms.

Benefits of Online Lenders

Comprehending Cooperative Credit Union Options

Credit rating unions are not-for-profit monetary cooperatives that supply an array of products and services comparable to those of financial institutions, consisting of financial savings and inspecting accounts, financings, credit history cards, and extra. This possession structure frequently converts into lower fees, competitive rate of interest rates on loans and savings accounts, and a strong focus on customer service.

Lending institution can be interesting people looking for a more individualized strategy to financial, as they normally prioritize participant satisfaction over earnings. Additionally, credit score unions usually have a solid area visibility and might offer financial education and learning sources to aid participants improve their financial literacy. By understanding the alternatives readily available at cooperative credit union, individuals can make informed choices concerning where to delegate their financial needs.

Exploring Peer-to-Peer Lending

One of the crucial attractions of peer-to-peer loaning is the potential for reduced interest rates contrasted to conventional economic organizations, making it an appealing option for consumers. In addition, the application procedure for getting a peer-to-peer finance is normally streamlined and can result see in faster access to funds.

Capitalists also profit from peer-to-peer lending by possibly gaining greater returns contrasted to standard financial investment alternatives. By removing the middleman, investors can straight money debtors and obtain a part of the rate of interest repayments. It's important to note that like any kind of investment, peer-to-peer financing lugs fundamental dangers, such as the opportunity of borrowers failing on their loans.

Government Assistance Programs

Among the evolving landscape of monetary services, an essential facet to consider is the realm of Entitlement program Programs. These programs play a crucial role in offering monetary aid and assistance to people and organizations during times of need. From welfare to bank loan, federal government help programs aim to minimize financial concerns and promote financial security.

One popular example of an entitlement program program is the Small Organization Management (SBA) finances. These fundings provide beneficial terms and low-interest prices to aid local business expand and browse challenges - best merchant cash advance companies. In addition, programs like the Supplemental Nutrition Support Program (BREEZE) and Temporary Help for Needy Families (TANF) offer necessary assistance for people and families facing economic difficulty

Additionally, federal government support programs prolong past monetary help, encompassing housing support, health care subsidies, and academic gives. These campaigns intend to resolve systemic inequalities, promote social welfare, and make sure that all people have accessibility to standard requirements and chances for advancement. By leveraging entitlement program programs, individuals and services can weather economic tornados and strive towards an extra secure monetary future.

Verdict

Report this page